Contrary to popular belief, the prestige of a Marais gallery address is no longer a guarantee of value; it’s often a hidden tax on new collectors.

- The traditional gallery model inflates prices by up to 30% to cover overheads like prime real estate and art fair fees.

- Digital platforms provide superior transparency, global access to emerging talent, and data-driven tools that empower buyers.

Recommendation: Use online marketplaces for discovery and price validation, then approach artists or galleries with the confidence of an informed insider, not an intimidated tourist.

The allure is undeniable. A weekend in Paris, strolling through the cobbled streets of the Marais, drifting from one pristine “white cube” gallery to another. For decades, this has been the pinnacle of the art-buying experience—a ritual steeped in prestige, culture, and the promise of discovering the next great artist. This romantic vision suggests that physical presence is the only true way to connect with art, and a Parisian post code is the ultimate stamp of quality. But for the modern, international collector, this picture is becoming dangerously misleading. The very atmosphere you’re paying for might be the biggest hidden cost in your acquisition.

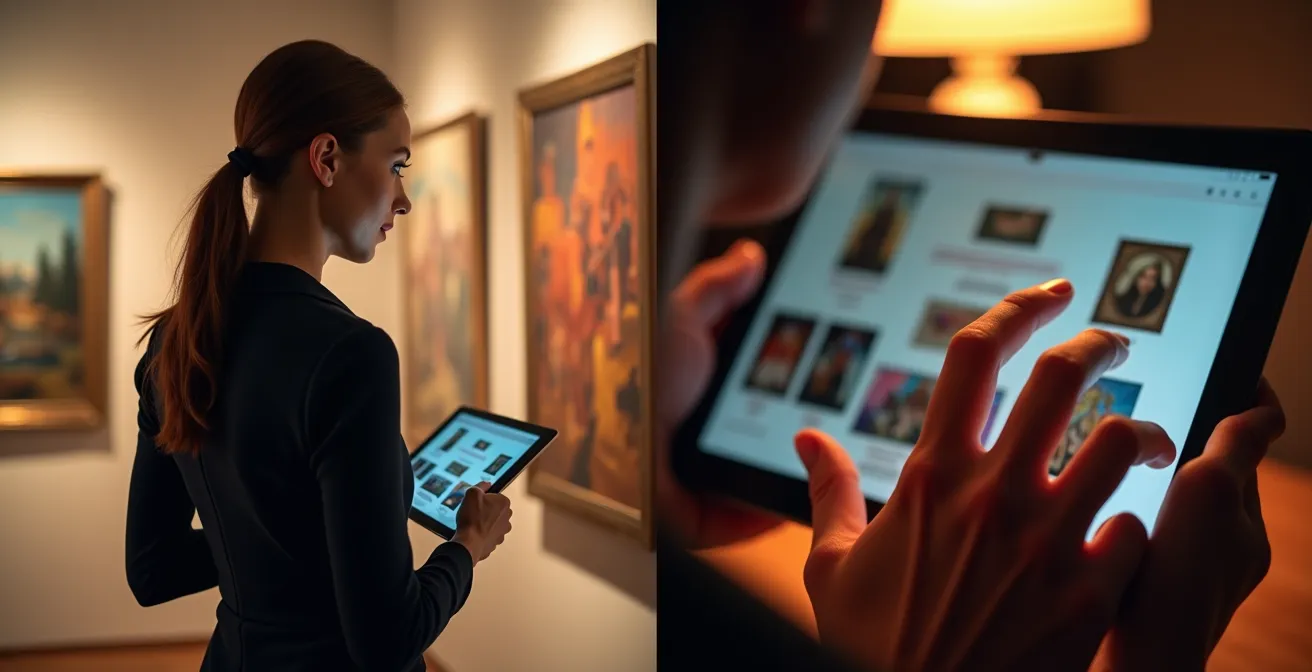

While the traditional path involves hushed conversations and opaque pricing, a parallel universe has exploded online. Digital marketplaces and social media have not just offered an alternative; they have fundamentally challenged the old guard’s control over access and information. The question is no longer simply about convenience versus experience. It’s about value, transparency, and power. What if the intimidation many feel walking into a top-tier gallery—that ‘white cube anxiety’—is not a personal failing but a feature of a system designed to keep newcomers at a disadvantage?

This article dismantles the myth of the infallible Parisian gallery. We will dissect the hidden costs embedded in a gallery price tag, expose the “prestige trap” where a prime address masks mediocre curation, and reveal the asymmetrical access that favors established insiders. More importantly, we will provide a clear, actionable framework for leveraging the digital world to scout, vet, and acquire Paris-quality art with more confidence and better financial intelligence, turning an intimidating process into an empowering one.

This guide will explore the critical friction points between the old and new art worlds. By understanding the mechanics of both physical galleries and online platforms, you can navigate the market like a seasoned professional, whether you’re in the heart of Paris or on your sofa a thousand miles away.

Summary: Navigating the New Art Market: A Collector’s Playbook

- Why Buying Art in the Marais Costs You 20% More for the Same Artist?

- How to Overcome ‘White Cube Anxiety’ When Visiting Top Tier Galleries?

- Physical vs. Digital Inventory: Which Offers Better Access to Emerging Talent?

- The Prestige Trap: When a Prime Address Hides Mediocre Curation

- How to Scout Paris-Quality Art in 30 Minutes Without Leaving Your Desk

- Why Top Tier Collectors Get Links to Exclusive Works 48 Hours Before You?

- Why Your $2,000 Painting Might Cost $2,600 After Entering Your Country?

- Online Art Marketplace: How to Secure the Best Deal on a Global Platform?

Why Buying Art in the Marais Costs You 20% More for the Same Artist?

The price of an artwork in a prestigious Marais gallery isn’t just about the artist’s talent or the materials used. You are paying for the “cost of atmosphere.” This premium, often adding 20-30% to the artwork’s base value, is a direct consequence of the traditional gallery’s business model. It’s a bundle of expenses passed on to the buyer, which includes some of the most expensive commercial real estate in the world, lavish opening night parties (vernissages), and the high cost of participating in elite art fairs. These are marketing expenses designed to build an aura of exclusivity around the gallery and its artists.

This model fundamentally contrasts with online platforms. While physical galleries operate with high fixed overheads, digital marketplaces leverage scalability. They don’t need a prime physical location, a large client-facing staff, or to ship entire exhibitions to Basel or Miami. This leaner operational structure allows them to charge lower commission rates, which in turn can translate to more accessible prices for collectors and a higher percentage of the sale going directly to the artist. The gallery premium is the price of a curated experience, but it’s crucial to ask whether that experience justifies the significant markup, especially when the same artist’s work might be available through other, more direct channels.

Understanding this pricing structure is the first step to becoming a savvy collector. It reframes the gallery from a mere showroom into a high-end retailer with significant operational costs. The list below breaks down the primary factors that contribute to this inflation.

- Gallery rent in prime locations: This can account for up to 30% of operating costs in districts like the Marais.

- Art fair participation fees: Major fairs such as Paris+ par Art Basel can cost a gallery over $50,000 just for their booth space.

- Marketing and PR budget: Between 15-20% of revenue is dedicated to building brand recognition for their represented artists.

- Curatorial certification premium: The gallery’s reputation and brand can add a 10-15% perceived value to an artwork.

- Secondary market management: Galleries actively invest in strategies to protect and enhance the resale values of their collectors’ acquisitions.

How to Overcome ‘White Cube Anxiety’ When Visiting Top Tier Galleries?

The term “white cube anxiety” perfectly describes the feeling of intimidation and inadequacy that many aspiring collectors experience when entering a high-end gallery. The minimalist decor, the echoing silence, and the seemingly aloof staff can make it feel more like a sterile museum than a retail space. This atmosphere is often by design, intended to project an aura of seriousness and exclusivity. However, it’s a significant barrier for those who want to learn and engage with art. The first rule to overcoming this is to remember that galleries are commercial businesses; they need visitors and, ultimately, buyers.

Demystifying the process is key. Most galleries are open to the public during their stated hours (typically Tuesday to Saturday, from 10 am to 6 pm), and no appointment is necessary. You are not an intruder. The staff, while often busy, are there to provide information. A simple way to break the ice is to walk in, sign the guestbook (which also gets you on their mailing list for future shows), and pick up the press release or exhibition list. This document is your cheat sheet, providing context about the artist, the concept of the show, and often the titles and materials of the works. It gives you a reason to be there and a framework for understanding what you’re seeing, instantly shifting your role from passive observer to engaged visitor.

It’s perfectly acceptable to ask for the price list, even if you have no immediate intention to buy. This is market research. Inquiring about prices shows genuine interest and helps you understand the artist’s market value. Remember the advice from industry insiders: treat it like any other high-end retail experience. You are allowed to browse.

First-Timer’s Gallery Visit Strategy

To make the experience more approachable, a managing director at the renowned Jeffrey Deitch gallery offers practical advice for newcomers. They suggest viewing galleries as you would any other shop: you can walk in during open hours without an appointment, and there’s no dress code. While you should never touch the art, you can even bring a well-behaved dog. To deepen your understanding of the exhibition, a great starting point is to sign the guestbook and pick up the press release. According to an insider’s guide to gallery hopping, this simple act transforms you from a browser into an informed visitor.

Physical vs. Digital Inventory: Which Offers Better Access to Emerging Talent?

A core argument for the traditional gallery system is its role as a gatekeeper of quality. Galleries invest significant time and resources into scouting talent at MFA shows, artist residencies, and studio visits. They act as curatorial filters, theoretically presenting only the most promising artists to their clients. This process is, by its nature, limited. A gallery’s roster is small, its physical space is finite, and its geographic reach is often regional. The barrier to entry for artists is incredibly high, with some top galleries accepting as few as 3% of applicants for representation. This creates a bottleneck, where a vast pool of global talent remains undiscovered by the traditional system.

Digital platforms shatter this bottleneck. Marketplaces like Artsy, Saatchi Art, or Singulart provide a global stage for hundreds of thousands of artists, offering collectors an unprecedented breadth of inventory. Instead of relying on a handful of gallery scouts, discovery is powered by algorithms, collector data, and powerful search filters. A collector can search for art by medium, color palette, price point, or even the artist’s location in minutes. This shift from human-led curation to data-assisted discovery democratizes access for both artists and collectors. While it places a greater onus on the collector to vet for quality, it also opens up a world of emerging talent that would never have made it onto a Marais gallery’s walls.

The following table, based on recent market analysis, outlines the fundamental differences in artist discovery between the two models.

The visual contrast is stark: on one side, a highly personal, localized, and limited method of discovery; on the other, a global, efficient, and infinitely scalable system. This is not to say one is inherently “better,” but for a collector focused on discovering new and diverse talent, the digital realm offers an undeniable advantage in sheer volume and reach.

This comparison of discovery methods, as detailed in a recent analysis of collector insights, highlights the structural differences between the two market approaches.

| Aspect | Physical Galleries | Online Platforms |

|---|---|---|

| Artist Pool | Curated selection from MFA shows, residencies | Global access to thousands of artists |

| Discovery Method | Gallery scouts at art schools | Algorithm recommendations, hashtag tracking |

| Barrier to Entry | High – only 3% of applicants accepted | Low – open marketplaces available |

| Geographic Reach | Limited to local/regional talent | Unlimited global reach |

| Collector Tools | Personal relationships, studio visits | Data analytics, price tracking, instant comparison |

The Prestige Trap: When a Prime Address Hides Mediocre Curation

The “prestige trap” is the mistaken assumption that a gallery’s prime location is a direct proxy for the quality of its art. A prestigious address in the Marais or on Avenue Matignon certainly indicates financial success, but it doesn’t automatically guarantee curatorial rigor or artistic vision. Some galleries thrive by catering to a decorative market, offering what are cynically termed ‘sofa-sized’ paintings—aesthetically pleasing but often critically shallow works that are easy to sell to wealthy tourists or interior designers. The prestigious facade can mask a commercial operation that prioritizes sales volume over artistic dialogue.

Another red flag is the deliberate opacity around pricing. The long-standing gallery practice of not displaying prices is often framed as a way to encourage conversation, but it can also be a strategic tool for price discrimination. As one expert points out, it creates an information imbalance that heavily favors the dealer.

Not displaying prices can create room to maneuver when a client walks into the gallery. Depending on the dealer’s assessment of his willingness to pay, the price can be adjusted upward or downward.

– Olav Velthuis, Arts sociologist, University of Amsterdam

This lack of transparency is a cornerstone of the prestige trap. It creates an environment where a collector’s perceived wealth or naivety can influence the price they are quoted. A truly great gallery distinguishes itself not by its address, but by the strength of its program: a coherent exhibition narrative, insightful curatorial texts, and a roster of artists whose work is in dialogue with contemporary culture. Learning to see past the expensive real estate and assess the curation itself is a critical skill for any serious collector.

Action Plan: Your Quality Curation Checklist

- Exhibition Narrative: Check for a coherent theme. Is it a thoughtful exhibition or just a random collection of the gallery’s “greatest hits”?

- Curatorial Context: Read the curatorial text. Quality galleries provide illuminating context that deepens your understanding, not just fluff.

- Artwork Dialogue: Look for a conversation between the pieces. The works should relate to and enhance one another thematically or aesthetically.

- Curator’s Background: Research the curator. In the modern art world, it’s often more telling to follow specific curators than gallery addresses.

- Secondary Market Performance: Verify the gallery’s track record. Check auction results for its artists on sites like Artnet to see if their market is stable or growing.

How to Scout Paris-Quality Art in 30 Minutes Without Leaving Your Desk

The idea that you must physically walk the streets of Paris to discover its best emerging art is an outdated romanticism. Today’s most effective art professionals and collectors leverage a suite of digital tools to gain market intelligence with surgical precision. With the right workflow, you can get a curator-level overview of the Parisian art scene in less time than it takes to drink your morning coffee. This isn’t about replacing the experience of seeing art in person, but about maximizing your efficiency and entering the market with a high degree of information.

The strategy involves a targeted, multi-platform approach. Instead of aimless browsing, you dedicate short, focused bursts of time to specific discovery channels. This digital-first methodology allows you to track gallery openings, monitor critical buzz, and see new inventory the moment it becomes available, often before the general public in Paris even knows about it. It transforms scouting from a day-long physical trek into a daily 30-minute strategic ritual.

This disciplined approach provides a constant stream of high-quality, relevant information, ensuring you are always aware of the most exciting developments in the market you’re targeting. The key is to move from passive consumption to active, focused intelligence gathering.

The 30-Minute Paris Art Discovery Workflow

Art professionals have honed an efficient digital routine. They recommend a three-part workflow: first, dedicate 10 minutes to browsing platforms like Artsy, specifically using filters for ‘Paris’ and ‘Recently Added’ to see fresh inventory. Second, spend 10 minutes on Instagram, checking the Stories of key Parisian galleries during their opening nights (vernissages) for virtual walkthroughs of new shows. Accounts like @thirstygallerina are excellent for curated highlights. Finally, use the last 10 minutes to scan the social media feeds of influential Paris-based art critics to see what they are currently discussing. This targeted, 30-minute approach delivers a potent dose of market intelligence, effectively replicating hours of physical gallery hopping.

Why Top Tier Collectors Get Links to Exclusive Works 48 Hours Before You?

One of the most significant, yet least discussed, aspects of the traditional gallery system is its use of asymmetrical access. Before an exhibition opens to the public, and long before any works appear on the gallery’s website, a carefully orchestrated selling process has already taken place. Galleries maintain tiered client lists and send out digital PDF previews of the show weeks in advance. The “A-list,” typically comprising museum curators, foundations, and the gallery’s most established collectors, gets the first look. The “B-list” follows. By the time the gallery doors open for the vernissage, the most sought-after pieces are often already sold or on hold.

This system inherently disadvantages new or unknown collectors. You are, by default, at the back of the line. This lack of transparency is a major source of frustration and a significant reason why many potential buyers hesitate. A recent report found that more than 69% of collectors have hesitated to buy art specifically due to a lack of transparency in the process. The feeling of playing a game without knowing the rules is a powerful deterrent. As one collector noted, this opacity creates a sense of distrust.

Without pricing transparency, you feel like you’re playing a game where you don’t know the rules.

– A Collector, Artnet News

So, how does a new collector break into this inner circle? It’s not about wealth alone. It’s about demonstrating genuine, informed interest. This means moving beyond passive visits. Follow up with a thoughtful email after a show, referencing specific works. Engage with the gallery’s program, attend artist talks, and build a relationship with the gallery director. By showing you are a serious, knowledgeable party, you can gradually move up the list. However, it’s a slow process that stands in stark contrast to the immediate, equal-access nature of most online platforms, where the “first come, first served” principle generally applies.

Why Your $2,000 Painting Might Cost $2,600 After Entering Your Country?

Securing a great price on a piece of art in a Parisian gallery is only half the battle. For an international collector, the “landed cost”—the final price after shipping, insurance, and import taxes—can come as a significant shock. A $2,000 painting can easily become a $2,600 liability by the time it reaches your doorstep. These ancillary costs are often overlooked in the excitement of the acquisition but are a critical component of the total investment. Galleries will often provide a shipping quote, but it may not include all the potential fees that will be levied by customs in your home country.

The three main hidden costs are shipping, insurance, and customs duties/VAT. International art shipping is a specialized service, far more complex than sending a standard package. Works must be professionally crated, and climate-controlled transit may be required. Insurance is non-negotiable and is typically calculated as a percentage of the artwork’s value. The biggest variable, however, is customs. Import duties and Value Added Tax (VAT) differ wildly from country to country. In the U.S., original works of art are often duty-free, but a ‘goods and services’ tax may apply. In the E.U. or the U.K., VAT can add a hefty 20% or more to the artwork’s value.

To avoid unpleasant surprises, a savvy collector must be proactive. You need to budget not just for the artwork, but for its entire journey. By employing smart shipping strategies, you can significantly mitigate these extra expenses and achieve full cost certainty before you commit to the purchase.

- Request DDP Quotes: Always ask for a “Delivered Duty Paid” (DDP) shipping quote. This forces the shipper to calculate and include all taxes and fees, giving you the true final cost.

- Use Specialized Shippers: Companies like Crozier or Hedley’s specialize in art logistics and often have better rates and insurance policies than general carriers.

- Consider Sea Freight: For larger, less urgent purchases, sea freight can save you 40-60% compared to air freight.

- Verify Artwork Classification: Ensure the customs declaration correctly classifies the work as “original art” to minimize duties. Prints or sculptures can fall into different tax brackets.

- Bundle Purchases: If you buy multiple works, consolidating them into a single shipment can dramatically reduce the per-piece shipping cost.

- Research Freeport Storage: For high-value acquisitions, consider using a freeport. These are tax-neutral storage facilities where you can store art without immediately paying import duties, deferring the tax liability until you decide to bring it into the country.

Key Takeaways

- The prestige of a physical gallery address is a poor indicator of curatorial quality and often inflates prices.

- Digital platforms offer unparalleled access to global emerging talent and superior tools for price transparency and market research.

- Overcoming “white cube anxiety” and understanding the hidden costs of shipping are crucial skills for the modern international collector.

Online Art Marketplace: How to Secure the Best Deal on a Global Platform?

The primary financial advantage of online art marketplaces lies in their lower overhead and commission structures. While a traditional gallery takes a 50% commission from the artist, major platforms like Saatchi Art typically charge a more modest 35% commission. This 15% difference creates a significant opportunity for value. It either allows the artist to price their work more competitively or to retain a larger portion of the sale, fostering a more sustainable career. For the collector, this structure often translates directly into more accessible price points for works of comparable quality.

However, the most sophisticated collectors use online platforms not just as a point of purchase, but as a powerful discovery and arbitrage tool. The ultimate strategy for securing the best deal involves using the curated environment of a top-tier platform for discovery, and then leveraging that information to connect directly with the artist.

This “platform arbitrage” strategy capitalizes on the fact that most artists maintain their own websites and studio stores. While a platform like UGallery provides excellent curation by accepting only 3% of artist applications, the artists on the platform often sell similar works on their personal sites at lower prices to avoid the platform’s commission fee. By using the platform to vet an artist’s quality and market, you can then approach them directly with a high degree of confidence. This often opens the door to not only better pricing but also to a more personal connection, including the possibility of studio visits (virtual or physical), payment plans, or custom commissions—benefits rarely offered to new buyers in a traditional gallery setting.

Platform Arbitrage Success Strategy

Experienced collectors have reported saving between 20-35% on acquisitions by employing a simple two-step process. First, they identify artists they admire on highly curated platforms known for their stringent selection criteria. Second, they locate the artist’s personal website or Instagram account and initiate a direct conversation. This method uses the platform as a free, high-quality discovery engine. Once a direct relationship is established, artists are often willing to offer more favorable terms, as a direct sale nets them a significantly higher profit margin than a sale through a commission-based platform. This strategy combines the quality assurance of a curated marketplace with the financial benefits of a direct transaction.

The myth of the Parisian gallery’s supremacy is crumbling. It’s being replaced by a more democratized, transparent, and global art market. The power is shifting from the institution to the individual—both the artist and the collector. The intimidation, opacity, and high costs of the traditional model are no longer the only price of admission. For the new generation of international collectors, the savviest move isn’t to walk the Marais, but to master the digital tools that provide a clearer, more honest view of the art world. Start by embracing this new paradigm and build your collection based on knowledge and confidence, not on an outdated notion of prestige.